While first-tier cities and hot-spot second-tier cities have increased the regulation of the property market, some third-and fourth-tier cities are welcoming "reverse" regulation, and "limit orders" have landed everywhere.

According to the incomplete statistics of The Paper, at least 7 cities have restricted the price reduction behavior of housing enterprises by interviewing them or issuing policies. However, behind the price reduction behavior, the debt pressure is high and the slow return of funds is a reality that some housing enterprises have to face, and a house price defense war is being staged.

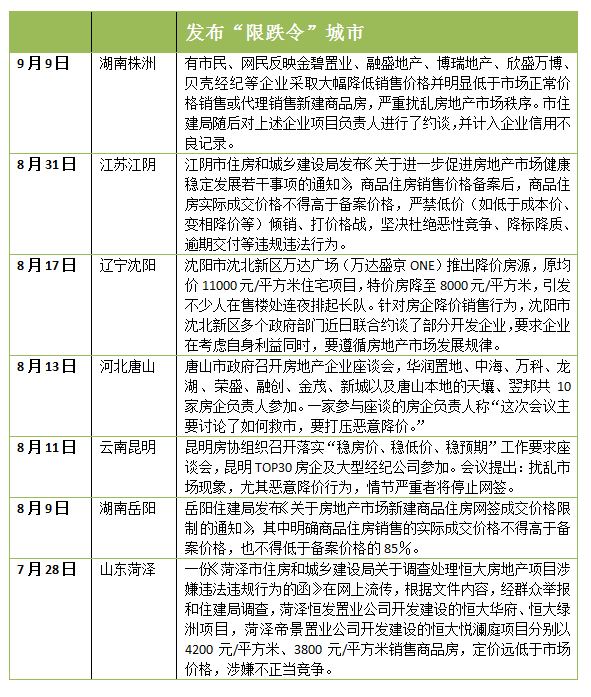

At least seven cities issued a "limit order"

According to The Paper’s incomplete statistics, up to now, seven cities including Zhuzhou, Jiangyin, Heze, Yueyang, Kunming, Shenyang and Tangshan have issued "price limit orders".

The reason why it is called "limit order" is that some real estate enterprises or intermediaries have been interviewed or stopped by the government when they sell or represent new commercial housing at a lower sales price and significantly lower than the normal market price.

Take Zhuzhou, Hunan Province as an example. On September 9th, some citizens and netizens reported that enterprises such as Jinbi Real Estate, Rongsheng Real Estate, Borui Real Estate, Xinsheng Wanbo, Shell Broker, etc. sold new commercial houses or sold them as agents at prices significantly lower than the normal market price, seriously disrupting the order of the real estate market. In this regard, Zhuzhou City Housing and Construction Bureau subsequently interviewed the person in charge of the above-mentioned enterprise project and included it in the bad credit record of the enterprise.

Earlier, on August 31, the Notice on Further Promoting the Healthy and Stable Development of the Real Estate Market issued by the Housing and Urban-Rural Development Bureau of Jiangyin City, Jiangsu Province clearly mentioned that after the sales price of commercial housing was put on record, the actual transaction price of commercial housing should not be higher than the record price. At the same time, it is strictly forbidden to dump at a low price (such as below the cost price, lowering the price in disguise, etc.) and resolutely put an end to vicious competition, lowering the standard and quality, overdue delivery and other illegal acts.

Judging from the cities that have announced the "limit order" at present, the main suppression in various places is malicious price reduction, and the sales pricing of some housing enterprises is far below the market price, which is considered to seriously disrupt the market.

Cartography: The Paper

What is the price reduction sales of real estate enterprises?

What are the reasons behind the price reduction of housing enterprises?

The scale of sales has "turned from rising to falling", and the pressure on housing enterprises to withdraw funds has increased or one of the reasons.

According to the data monitoring released by the National Bureau of Statistics, Tongce Research Institute showed that in July, the sales area of commercial housing nationwide was 115 million square meters, down 9.45% year-on-year and 40.6% quarter-on-quarter. This is also the first time in the past year that "from rising to falling", indicating that China’s real estate sales have entered a downward channel.

From the perspective of development fund structure, the proportion of sales return to financing reached 57.15%, which was 3.9 percentage points higher than that in 2020, and the proportion of domestic loans to financing was 12.95%, which was 0.87 percentage points lower than that in 2020. This shows that the financing of housing enterprises mainly depends on sales return, and it is on the rise. In the future, the financing of housing enterprises mainly depends on "self-hematopoiesis". The growth of sales scale for the first time "from rising to falling" shows that the core source of funds for housing enterprises has begun to decline, and the pressure on housing enterprises to withdraw funds has increased.

Sun Hongbin, Chairman of Sunac China’s Board of Directors, mentioned at this year’s interim results meeting that the market pressure in the second half of the year is relatively large, which mainly comes from two aspects. One is that some enterprises started to cut prices when they were under pressure, and the other is that the national policy is relatively firm, which made everyone expect that the house price would not rise. Now the economic pressure is relatively large, and everyone’s purchasing power has been affected.

Sun Hongbin believes that the current market is particularly like 2018. "The whole credit market is short of funds. In the first half of the year, sales were relatively good, and loans were relatively difficult. However, loans in the second half of the year were still equally difficult, and the sales market fell sharply. The sales pressure in the second half of this year is very high, and it is expected that the market will still be fierce in the second half of this year. "

The turn of the property market may also become an industry consensus. Guo Yingcheng, Chairman and Executive Director of Kaisa Group, said at the performance meeting that in recent years, especially this year, the regulation of the real estate market has been more precise and the implementation of policies has been faster than before. At the same time, however, we are also facing great challenges. After precise regulation and control, after the sale of the sales end, the withdrawal of mortgage funds may be slower than before, which also brings certain pressure to enterprises.

In addition, debt pressure is also a "sword" hanging over some housing enterprises.

According to the relevant data released by the same policy research institute, the debt due to housing enterprises reached 1.2 trillion this year, with an average monthly debt of over 100 billion. The average debt ratio of the real estate industry in the second quarter was 77.85%, which was 1.34 percentage points lower than that in the first quarter and 1.23 percentage points lower than that in 2020 when three red lines were proposed. This shows that the effect of regulation has begun to appear, and housing enterprises regard reducing debt and optimizing the three red lines as their primary strategies. At the same time, however, more stringent regulatory measures have also accelerated the exposure of some housing enterprises to their debt defects, and the cases of default of housing enterprises’ bonds are increasing.

According to the statistics of RealData, since this year, the phenomenon of bond default in the real estate industry has increased significantly compared with the past two years. In just 6 months, there are 12 real estate enterprises that have defaulted.

Song Hongwei, research director of Tongce Researcher, believes that in the first half of the year, when the real estate market sold well, it was easier for housing enterprises to withdraw funds to pay debts. However, since July, the whole industry has entered the downward channel, and it is difficult to withdraw funds, and the pressure of paying debts is prominent. For cash flow, selling at a reduced price and exchanging prices for quantity has become the choice of many housing enterprises.

Facing the current market environment, Xu Shitan, the chairman of Shimao Group, mentioned at the interim results meeting that the policies of housing, no speculation, three red lines and concentration management will continue. Under such a policy background, it is no longer suitable for enterprises to emphasize high growth rate, so the company’s strategy is to "turn from attack to prevention" and at the same time increase the assessment of cash and repayment rate.

Xu Shitan said that the company has taken some measures to resist the market downturn. The company analyzed the sales in July and August, and the sales of the whole industry declined. In September and October, the company arranged many supply and sprint targets. At present, there is still a gap in the mortgage amount. The company dynamically manages the price and promotes preferential measures for buyers with high down payment ratio. Not only that, Xu Shitan also revealed that the price will be dynamically managed in the second half of the year, and at the same time, preferential measures will be increased.

Can the price be reduced?

The decline in housing prices should have been a good thing in the eyes of many people. Why is there a "limit order"? China News Network appeared at the same time in the "Price Limit Order" and "Price Limit Order". What happened to the property market? As mentioned in the article, house prices are not "unable to fall", but "don’t fall blindly".

In the view of Li Yujia, chief researcher of Guangdong Housing Policy Research Center, "three stabilities" are the targets of property market regulation, whether for the central government or for the local government. Ups and downs are not desirable, and may trigger market expectations fluctuations and further strengthen this ups and downs. In other words, if there is a significant decline, it may lead to further decline due to market expectations, forming a downward cycle. At this time, it is necessary to prevent the formation and circulation of this expectation through government intervention.

The relevant staff of Yueyang Housing and Construction Bureau also said in response to the "Notice on the Transaction Price Limit of New Commercial Housing Online Sign in the Real Estate Market" that the debt pressure of leading housing enterprises is relatively high recently, and the price of real estate is maliciously reduced in order to withdraw funds, resulting in market confusion. This is the main reason for the introduction of the policy.

A marketing person of a TOP40 real estate enterprise pointed out, "When there is a correction in the market, many developers will carry out certain price reduction promotions according to their own conditions. Of course, the market is still divided. There is not much inventory problem in first-tier and second-tier cities, but the third-and fourth-tier properties are relatively slow to be converted during the property market correction period, so it is normal that we will give some concessions to accelerate sales. The government is mainly cracking down on malicious price cuts, fearing that it is not conducive to market stability and will also trigger social events such as rights protection. "

"The downward pressure on housing prices in some cities is indeed increasing. According to the data released by the Bureau of Statistics, in recent months, the number of cities with a downward trend in house prices has been increasing, and the pressure on housing enterprises to reduce debts has also been increasing, which has led to the phenomenon that housing enterprises in some cities or regions have accelerated the pace of shipment and reduced prices. However, once the price reduction behavior of housing enterprises triggers a price reduction tide, it will trigger a chain reaction, which will greatly affect the orderly development of the real estate market, and will also affect the land market and have a greater impact on the local economy. " Zhang Bo, dean of the branch of 58 Anjuke Real Estate Research Institute, said.

So, is the "limit order" effective? In Li Yujia’s view, the property market is running at the highest level in history, and all parties have high demands for stability. Whether it’s a rapid rise or a rapid decline, whether it’s a whole city or a part of the city, it’s necessary to intervene appropriately, including not allowing large-scale price reduction marketing. This is the same logic as not allowing large-scale rise, and this intervention must be effective.

Guo Zhen, a researcher in the real estate industry of GF Securities Development Research Center, told The Paper that the government does not want to see the situation that house prices have been falling after the real estate enterprises bid with each other, which will also make the market enter a relatively vicious state, so it has been the direction of regulation and control in recent years to maintain the stability of house prices without sharp rise or fall.

Liang Nan, an analyst at Zhuge Housing Search Data Research Center, pointed out that from the perspective of cities that have issued "limit orders" at present, they are basically cities with high inventory and high pressure to remove chemicals. Perhaps some developers have drastically cut prices to speed up the sales repayment, which has led to market chaos to a certain extent, which is not conducive to the development of the property market. The introduction of the "limit order" policy can effectively curb the rapid decline in housing prices, avoid market chaos such as sharp price cuts, and further standardize the transaction behavior of the property market, which is conducive to promoting the healthy and stable development of the real estate market.

(This article is from The Paper, please download the "The Paper" APP for more original information)

关于作者