In recent years, more and more people have started to keep pets, and the pet track has also become hot. With the rise of pet economy, there are many users who socialize through pets, and pet social products are also developing constantly. This article evaluates pet social products, let’s take a look.

- Understand the current situation and development trend of the pet market industry by studying the market background of the industry.

- By combing the product positioning, functional structure and business model of different competing products, the development trend, operation mode, business mechanism and characteristic function points of their products are analyzed.

- Through the analysis of competing products and my own thinking, this paper puts forward the summary and suggestions on pet social products.

- Improve the individual’s ability to write competitive product analysis reports.

(1) Market size

China’s pet economy continues to heat up and the market scale grows steadily.

China’s pet industry started late. With the increase of national income and the continuous expansion of pet owners, the types of goods and services related to pet consumption are constantly enriched, and the market scale of China’s pet industry is expanding rapidly. After 2020, the pet industry in China will enter a mature stage. With the rise of domestic pet brands, the market share of overseas brands has gradually decreased, and the new online+offline retail model dominates the market. There are many participants in the pet industry, and the market structure is relatively scattered, and the concentration is expected to be further improved.

According to the white paper data of pet industry, the market size of China’s pet industry (dogs and cats) reached 270.6 billion yuan in 2022, up 8.7% year-on-year, and the compound annual growth rate from 2012 to 2022 was about 23.2%. With the continuous improvement of the penetration rate of pet families and the maturity of the industry, it is estimated that the market size will increase by 297.7 billion yuan in 2023.

Source: White papers on pet industry over the years.

(2) Development space

Compared with developed countries, China’s pet penetration rate is low and there is a big room for development.

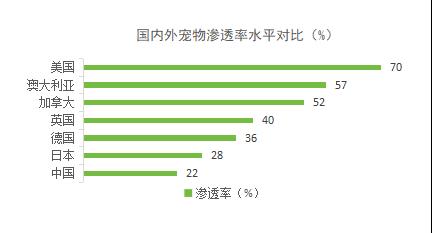

As the earliest and fastest-growing country in the global pet industry, America’s pet economy has entered a mature and stable period. In 2021, the penetration rate of pets in the United States ranked first in the world, and American families with dogs and cats accounted for more than 70%. On the other hand, the development of pet economy in China is entering the fast lane, and the penetration rate of pets is relatively low, about 22%. On the whole, there is still a big gap between China’s pet penetration rate and overseas developed countries, and the industry still has a big room for development in the future.

Data source: public information collation and insight research report analysis.

(3) consumption structure

The penetration rate of sub-categories is relatively stable, the penetration rate of snacks and nutrition products has increased slightly, and the penetration rate of drugs has increased greatly.

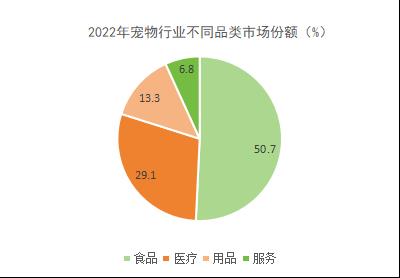

As just-needed products for pets, food is still the main consumer market for pets, with a market share of 50.7%. Among them, the penetration rate of snacks and nutrients increased significantly, accounting for 84.7% and 66.1% respectively. Among them, the market share of staple food and snacks decreased slightly, while the market share of nutritional products increased slightly. In terms of pet medical treatment, the market share of dogs’ medical treatment was 29.1%, which was 0.8 percentage points lower than that in 2021, including 1.6 percentage points lower for diagnosis and treatment and 0.7 percentage points higher for medicines. The medical market share of cats is 29.2%, up 0.6 percentage points from 2021. In addition, the market for supplies and services has a large room for growth. The market penetration rate of pet products increased slightly compared with 2021, with a market share of 13.3%. The market share of pet service is 6.8%.

Source: White Paper on Pet Industry in China-Report on Pet Consumption in China in 2022

(4) consumption channels

In recent years, pet e-commerce channels have developed rapidly, and domestic brands have quickly seized the market with the advantage of high cost performance. At the same time, due to the decline in the proportion of traditional channels, the advantages of foreign pet food enterprises in traditional channels such as Shangchao have gradually shrunk.

The data shows that in 2022, 62.9% of consumers tend to buy pet food through online e-commerce platform, which accounts for a much higher proportion than other channels, and online shopping has become the mainstream scene. And 67% of consumers think that domestic brands are more cost-effective and more and more in line with international standards. In the future, domestic brands are expected to be laid out through channel construction, brand marketing, category development, etc., and the market share may be further improved.

Data source: Euromonitor, public information collation.

From the data analysis, China’s pet economy has steadily increased, and the market scale has been steadily increasing, which has survived the stage of the overall economic environment decline. Now the pet industry has great opportunities; Compared with some developed countries in the mature stage of pet industry, the domestic pet industry still has great room for development; Due to the continuous upgrading of the role of pets in pet owners’ families, consumers’ consumption stickiness in the pet field is gradually strengthening; From the perspective of consumption channels, online shopping has become the mainstream scene.

(1) Age distribution of pet owners and users

Pet owners show a "two-terminal" growth trend, with the number of young pet owners increasing continuously and the number of older pet owners increasing slightly.

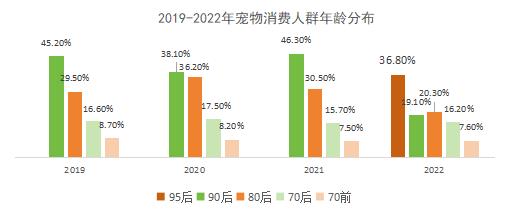

The pet population presents a younger distribution, and the post-80 s and post-90 s become the main consumers. Due to the differences in educational background, lifestyle, growth environment, etc., young people have a relatively high acceptance of the concept of pet raising and a higher emotional demand for pets. The data shows that in 2022, pet owners are further younger, and after 95, pet owners have dominated, reaching 36.8%; Compared with 2021, the proportion of pet owners after 80s decreased by 10.2 percentage points; After 70, the proportion of pet owners rebounded, rising by 0.5 percentage points.

Source: White Paper on Pet Industry in China-Report on Pet Consumption in China in 2022

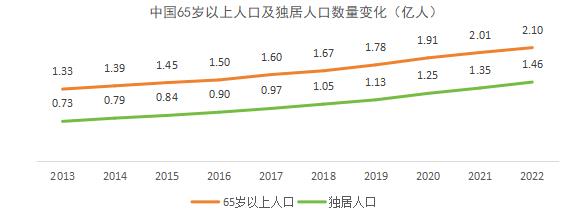

In addition, with the growing number of empty nesters and young people living alone, the "lonely economy" has promoted the upsurge of pet raising, pets have gradually become emotional sustenance, and family attributes have been further strengthened. The data shows that in 2022, the population aged 65 and over in China is about 210 million, accounting for 15% of the total population; The number of people living alone has rapidly increased from 70 million in 2013 to 146 million in 2022, which has created a good environment for the rapid growth of the pet industry.

Source: National Bureau of Statistics.

(2) Income and consumption of pet owners

The frequency of pet consumption by pet owners is mostly concentrated in 1-2 times or 3-4 times per month; Pet consumption is mainly reflected in pet food, supplies and medical care. 88.3% of pet consumers in China spend more than 500 yuan annually; The higher the population in disposable personal income, the more they spend on pets. This means that the consumption and demand of the pet industry will also maintain steady growth under the social macro-background of the current steady growth of national consumption.

Source: Shanghai Securities

(3) Consumption stickiness

The change and continuous upgrading of the role of pets has strengthened the consumption stickiness of consumers in the field of pets.

In order to improve the health and quality of life of pets, the average consumption amount of a single pet has increased steadily-from 1,532 yuan/pet in 2017 to 2,216 yuan/pet in 2021, and the consumption upgrading trend appears. At the same time, according to the changes of pet consumption demand, consumers also gave birth to new consumption scenes such as pet photo, social intercourse and birthday, further consolidating the growth foundation of pet consumption amount.

Source: Gongyan.com.

(4) pet factors change user needs.

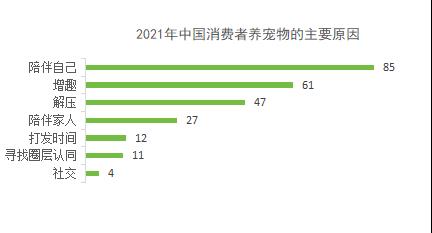

In recent years, the reasons why consumers are fond of pets have also changed. Compared with the early domestic animals, whose main motivation was "use value", modern urban families began to raise pets based on "emotional value". 85% of consumers keep pets for companionship, followed by fun (61%) and decompression (47%).

From the perspective of pet-keeping motivation, pets are given more emotional roles to accompany their owners and add interest. The role of pets is mainly friends and family with companionship function, and pet owners are more willing to devote themselves to their pets and spend time, energy and money to get a better pet raising experience.

Source: iResearch (as of March 2021)

Among the pet owners, the proportion of young people and old people is gradually increasing, and the pet owners after 1995 are dominant. The "lonely economy" promotes the upsurge of pet raising, and the group of young people living alone and empty nesters is huge, which also creates a good environment for the pet industry.

The spiritual needs of pet owners are increasing day by day. Young people’s acceptance of the concept of pet ownership has also changed, and they are more willing to uphold the concept of pet ownership such as scientific feeding. At the same time, the proportion of high-income people has gradually increased, which has also made the consumer demand of the pet industry gradually increase. The change of pet-keeping motivation has changed the role of pets in the family, and pet-keeping people are more willing to spend more time, energy and money to improve the pet-keeping experience.

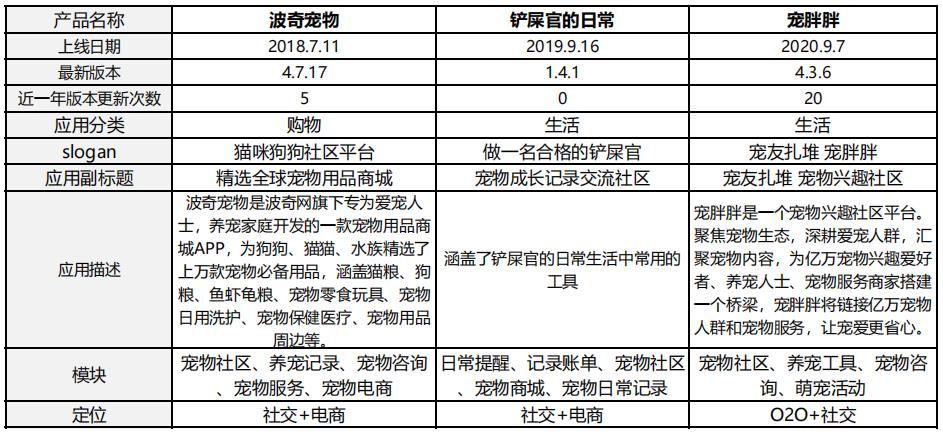

In this paper, the direct competing products in the existing APP products in the App Store are selected for analysis. Pets can be divided into two categories: pet mall and pet community. Search the pet community from the seven wheat data website, and select the top two products in the past month as the main competing products under this classification. (Inquiry date is August 29th, 2023)

According to the search results, the top two products in the pet community category are "daily life of the shovel officer" and "pet fat" for analysis.

TOP3 Competition Trend of Search Results of "Pet Community" in the Last Month

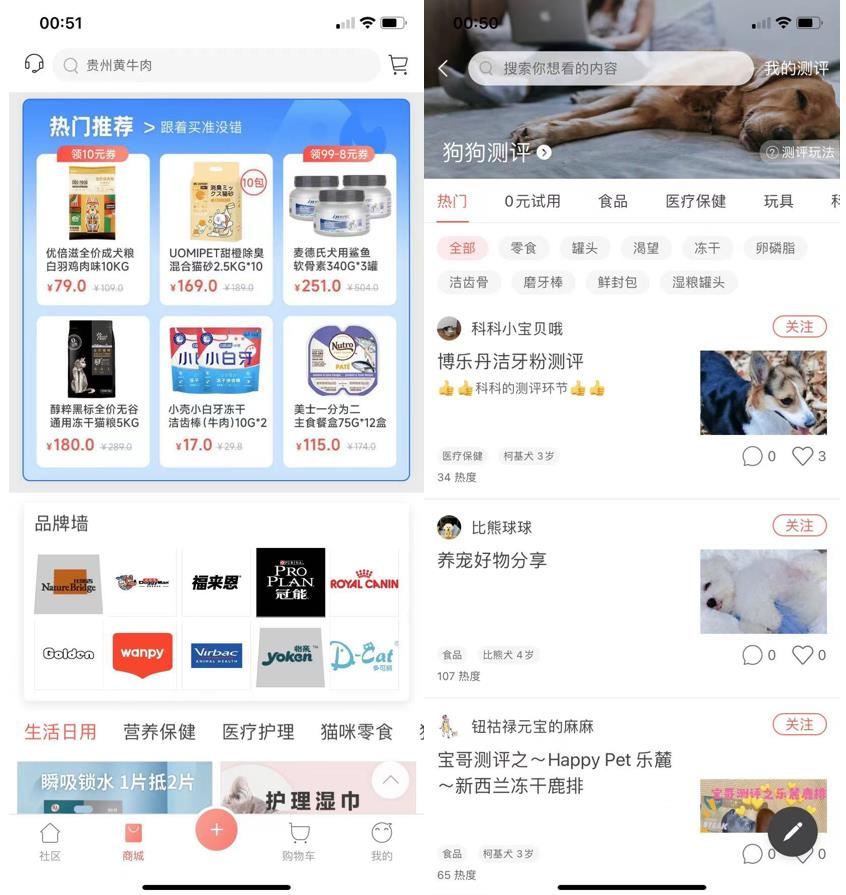

These three products have different emphases and outstanding fields. Boqi pet is mainly based on pet e-commerce and operates products in the form of community; The daily life of shovel officials is mainly based on community sharing and pet keeping records, and there is also a pet e-commerce part, which pays more attention to and emphasizes the instrumental nature of products; Pet Fat is based on the community of interest, and provides users with more comprehensive and convenient services in the form of online and offline cooperation.

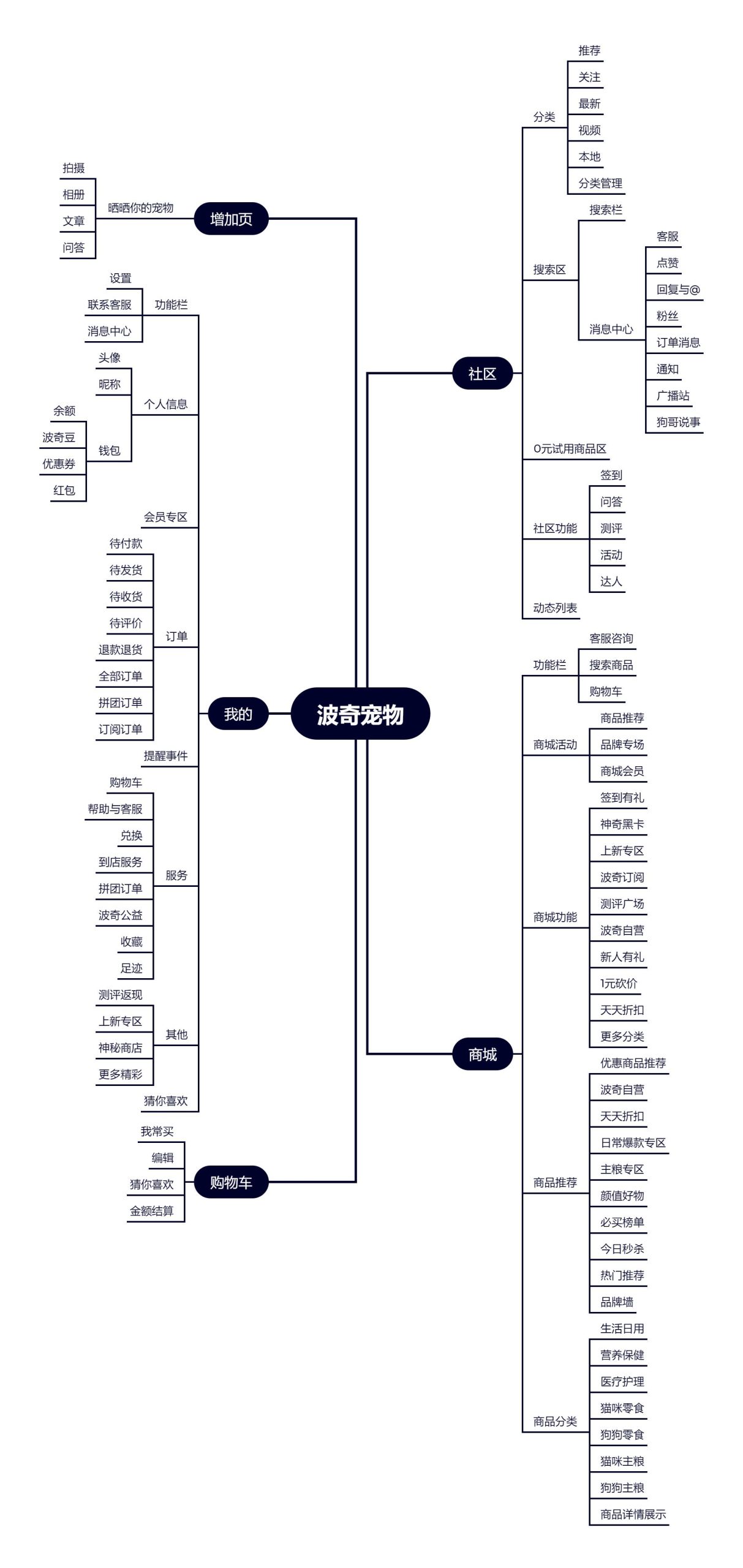

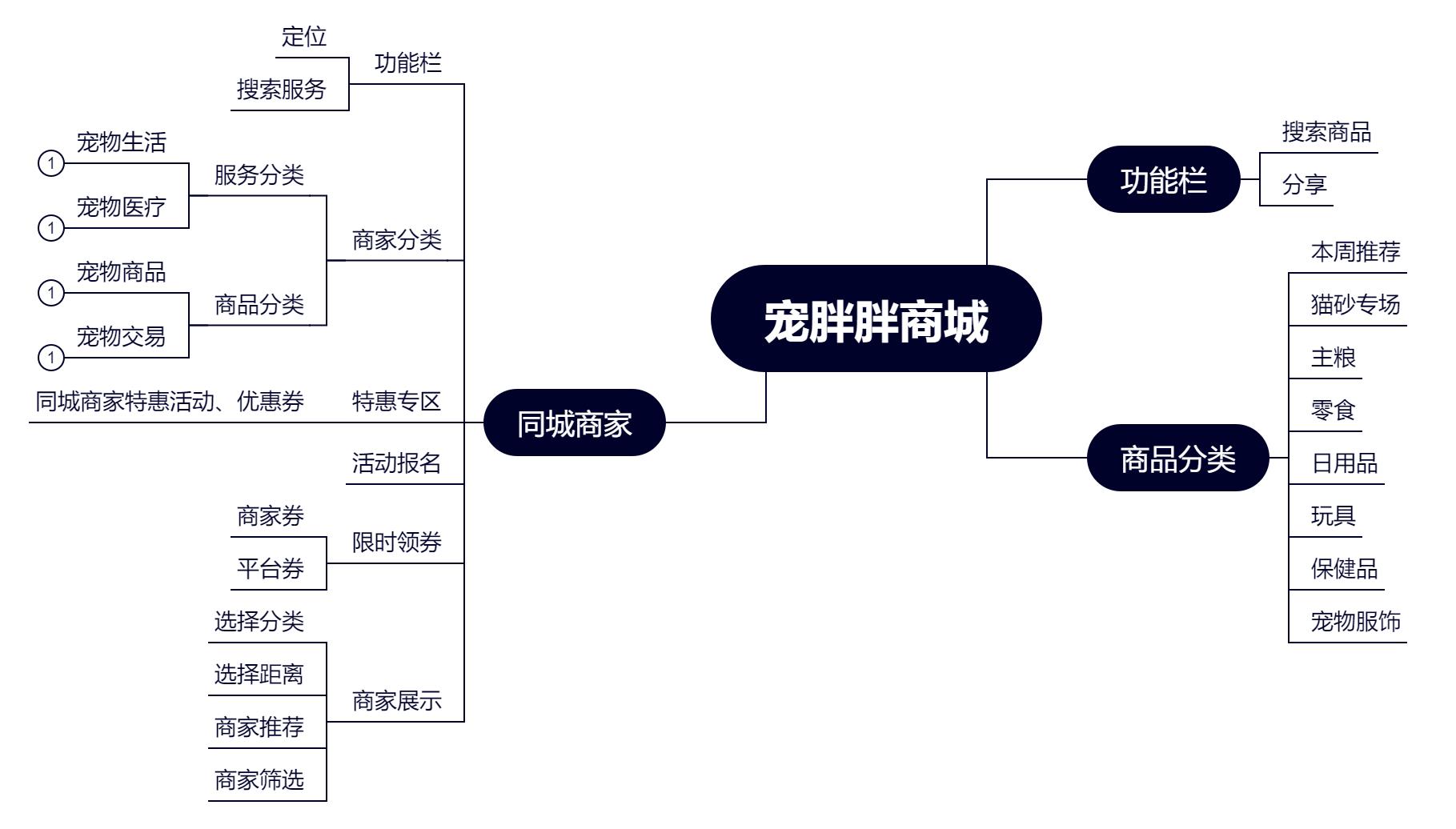

Boqi Pet APP Product Structure Diagram

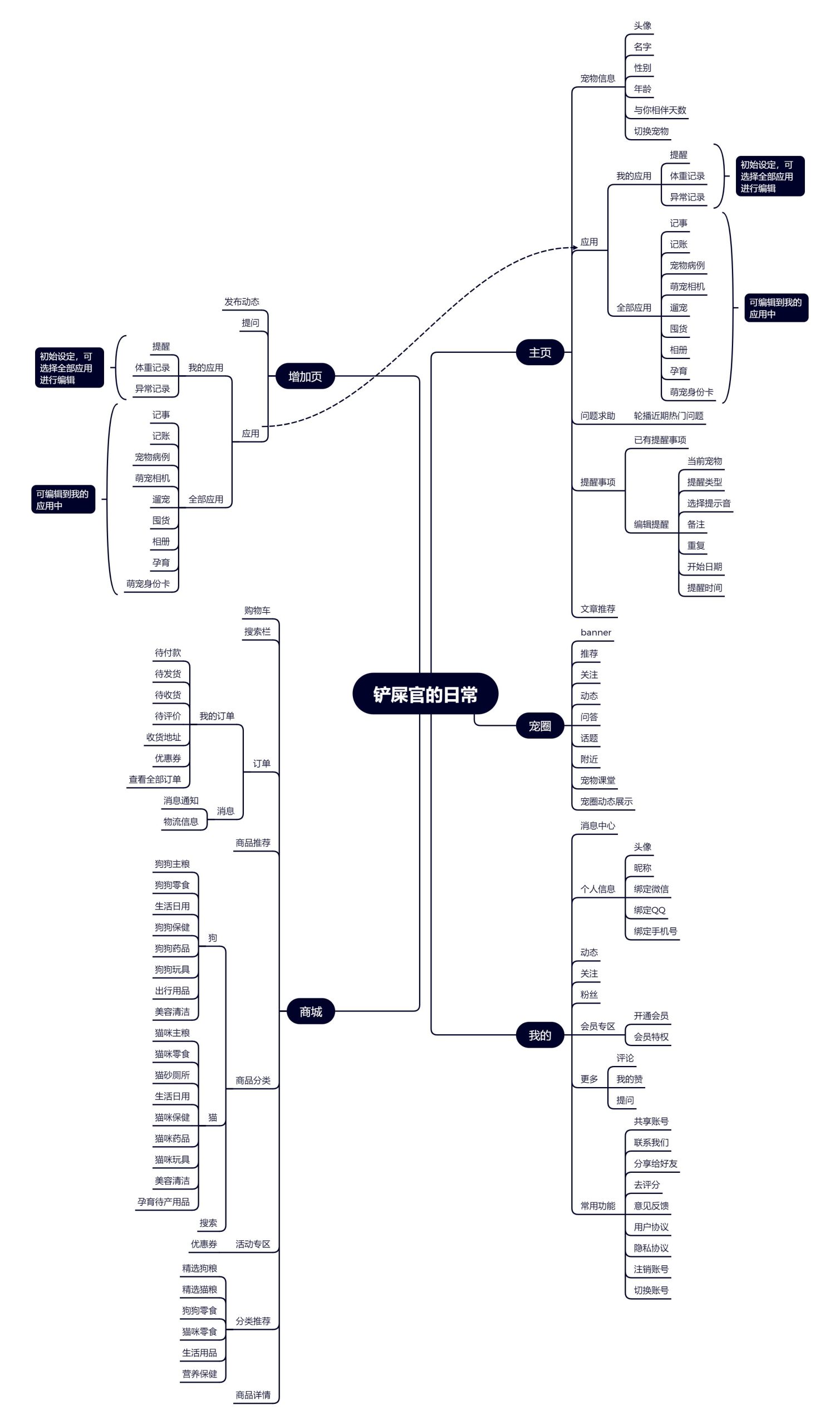

Structure diagram of daily APP product of shovel officer

Product structure diagram of Pangpang APP

The positioning and core functions of each product can be seen from the product structure diagram.

The product of Boqi Pet APP is positioned as a community+e-commerce pet products mall app. As can be seen from the product structure, its function focuses on the mall part, and its community function is more about assisting the e-commerce part.

The daily life of shovel officials is mainly based on online community and pet e-commerce. Compared with the other two products, the daily product structure of the shovel officer also provides an entrance for the e-commerce part on the first-level page, which meets the product positioning and adopts the product model of community+e-commerce.

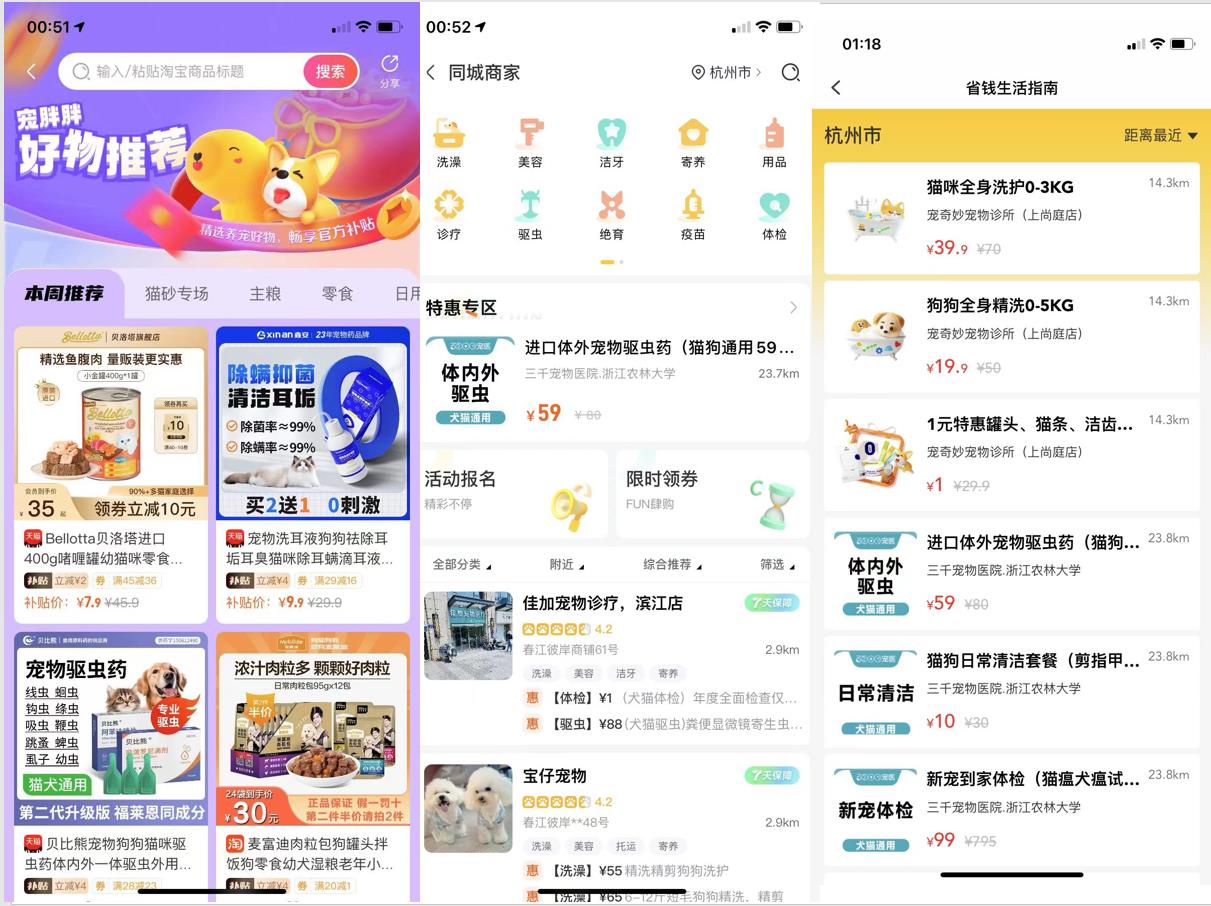

There are very rich contents under the pet-raising function, including medical treatment, e-commerce, pet-raising tools, daily records and other modules. At the same time, online to offline, a pampered city, can effectively contact merchants and users in the same city, and provide a platform for merchants in the same city in the vertical field.

The above is the induction and summary after experiencing three products. By comparison, we can draw the following conclusions:

① High coincidence of core functions.

All three products are in the form of content output, with community sharing as the core function. Users can publish trends on the platform, share the daily life of pets or experience planting grass in the output products, and create a community exclusively for pet owners to interact with each other through content. At the same time, the function of planting grass or using pet mall can realize the profit of pet e-commerce in the products. In addition to the interactive community, while the core functions are developing steadily, all platforms have also broadened their business scope to varying degrees, such as medical care, popular science, daily records, regular reminders, etc., and finally formed a phenomenon of high overlap of functions.

② There are differences among individual functional plates.

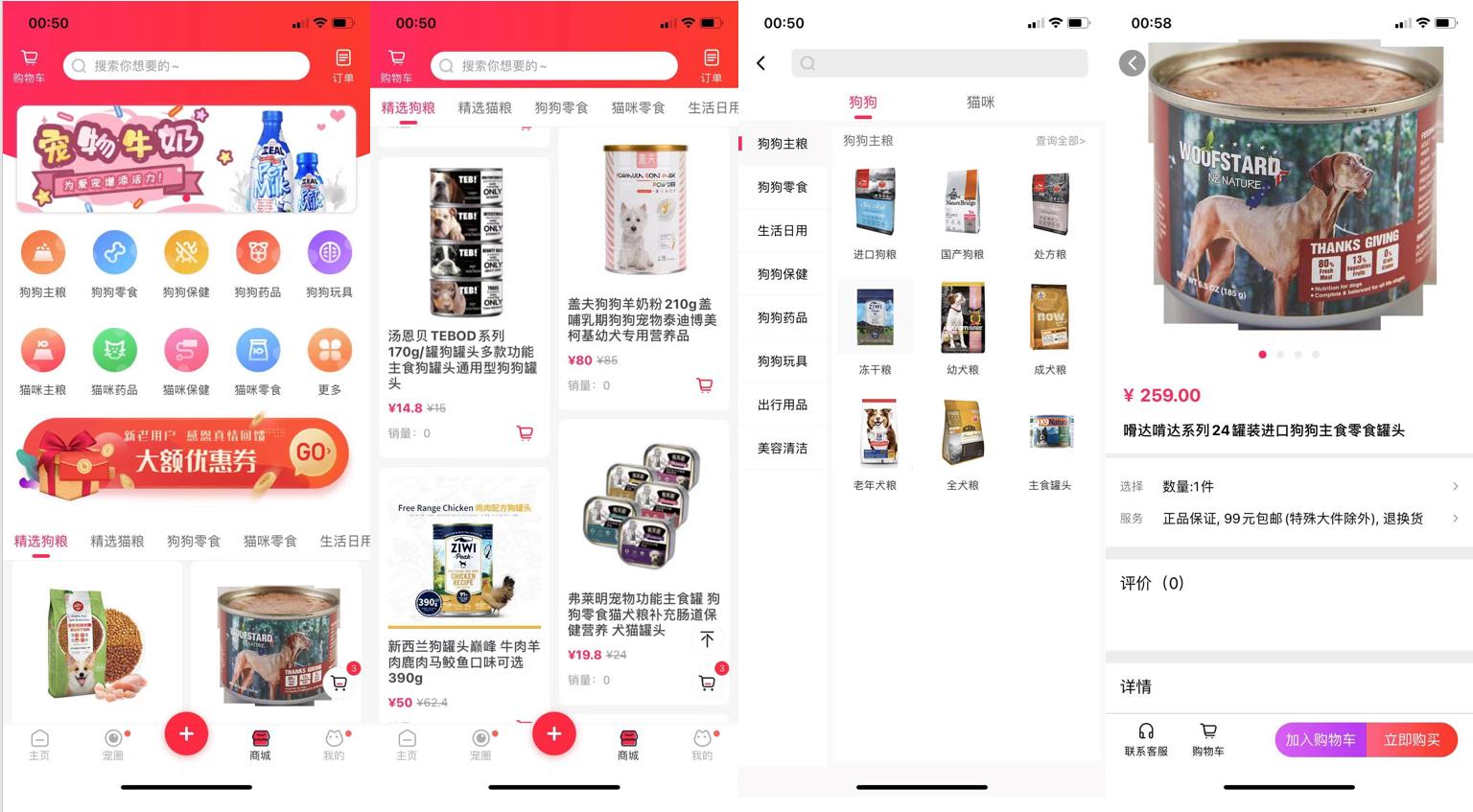

There are differences in the functional arrangement of the home page of each product. Boqi Pet arranges some functions of e-commerce and community dynamic display on the home page at the same time. The daily homepage of the shovel officer only arranges daily functions and popular science article recommendations, and arranges all community dynamics on the pet circle page; The home page of Pet Fat is the community dynamics. It recommends the display of graphic notes with double feed streams, and arranges all pet raising functions on the pet raising page. The e-commerce sector also has its own emphasis, and the Boqi pet platform has its own pet products; The daily shopping mall of shovel officer is rich and comprehensive, and the function of the whole shopping mall is mature; The products in Pangpang Mall are linked to other platforms in the form of a third party, which mainly plays a guiding role, but the O2O function of this product is more perfect than the other two products, forming a good cooperation model with offline stores.

③ The emphases of different products are different.

The core function of these products is the pet community, but in different products, the proportion of the pet community plate is different, and other functions except the community also have their own characteristics. From the arrangement of different first-level pages of each product, we can see the functional focus of each product. Boqi Pet strives to build an e-commerce platform to assist the main business with community functions; However, the daily life of the shovel officer focuses on the tool attribute of the product, and the community attribute is weak; Pangpang focuses on its pet community plate, and at the same time provides a more comprehensive pet raising function. Among these products, the medical and city functions of Pangpang are more prominent.

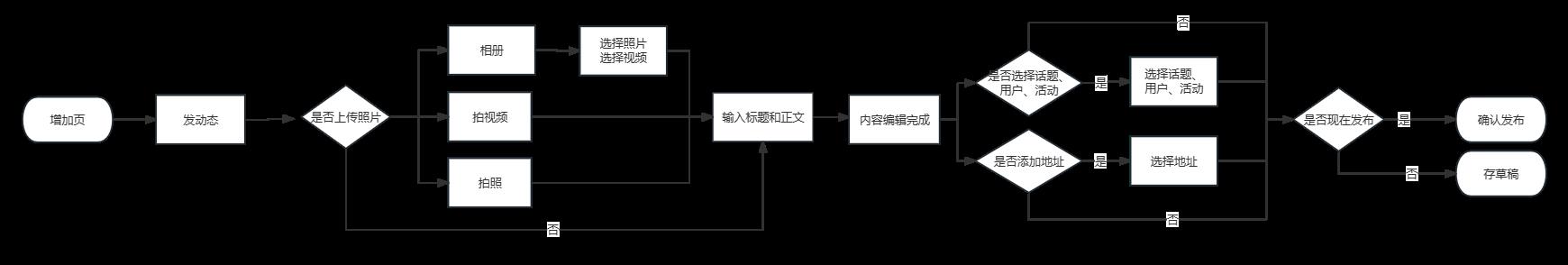

The following is an analysis of the core processes of some major functions of each APP. The product experience analyzes the two core functions of pet community and pet e-commerce. Taking "publishing dynamic function" and "pet e-commerce function" as the breakthrough points, this paper experiences from these two functional modules, compares the same functions in different products, and puts forward improvement suggestions for product optimization.

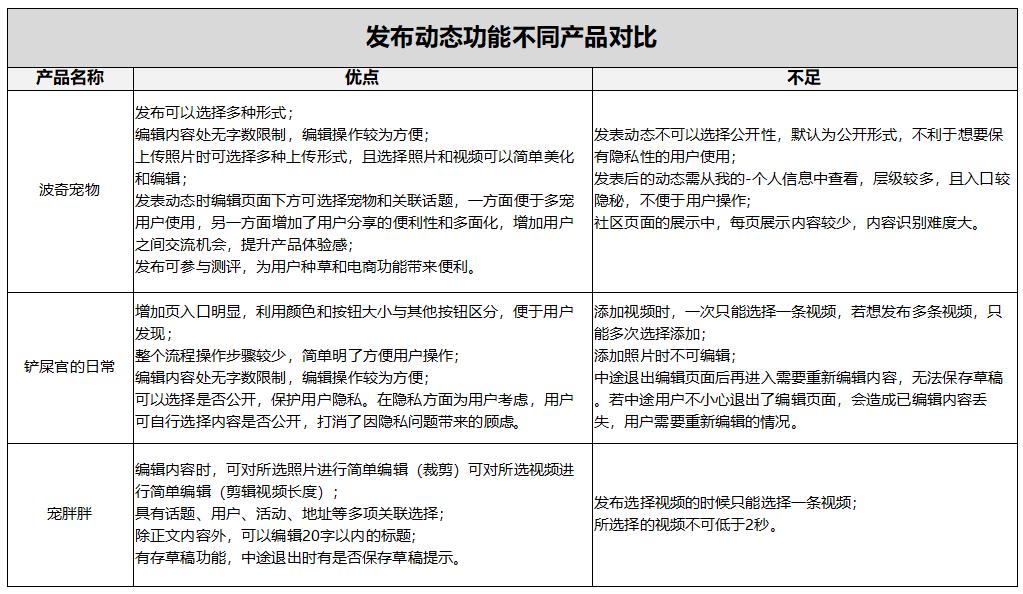

(1) Publishing dynamic functions

① Boqi pet

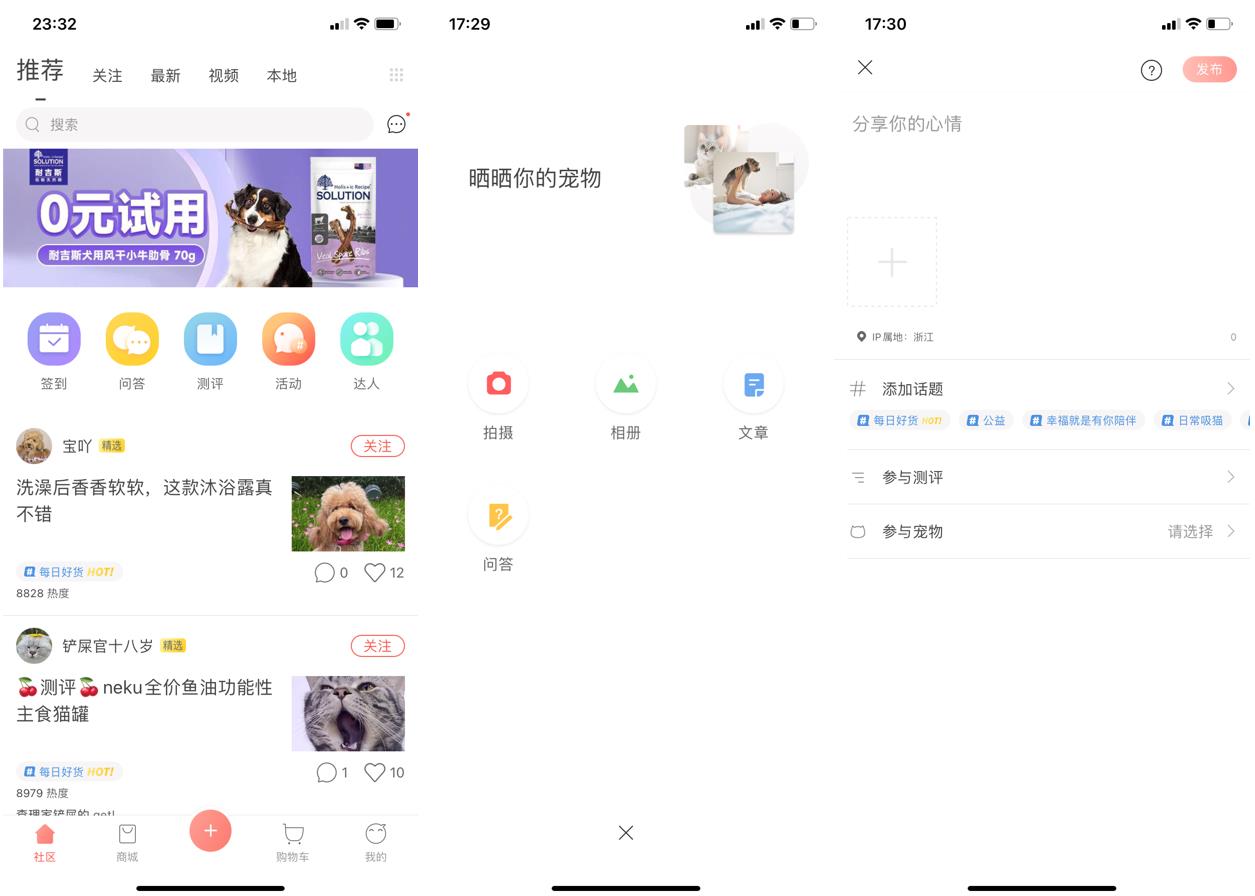

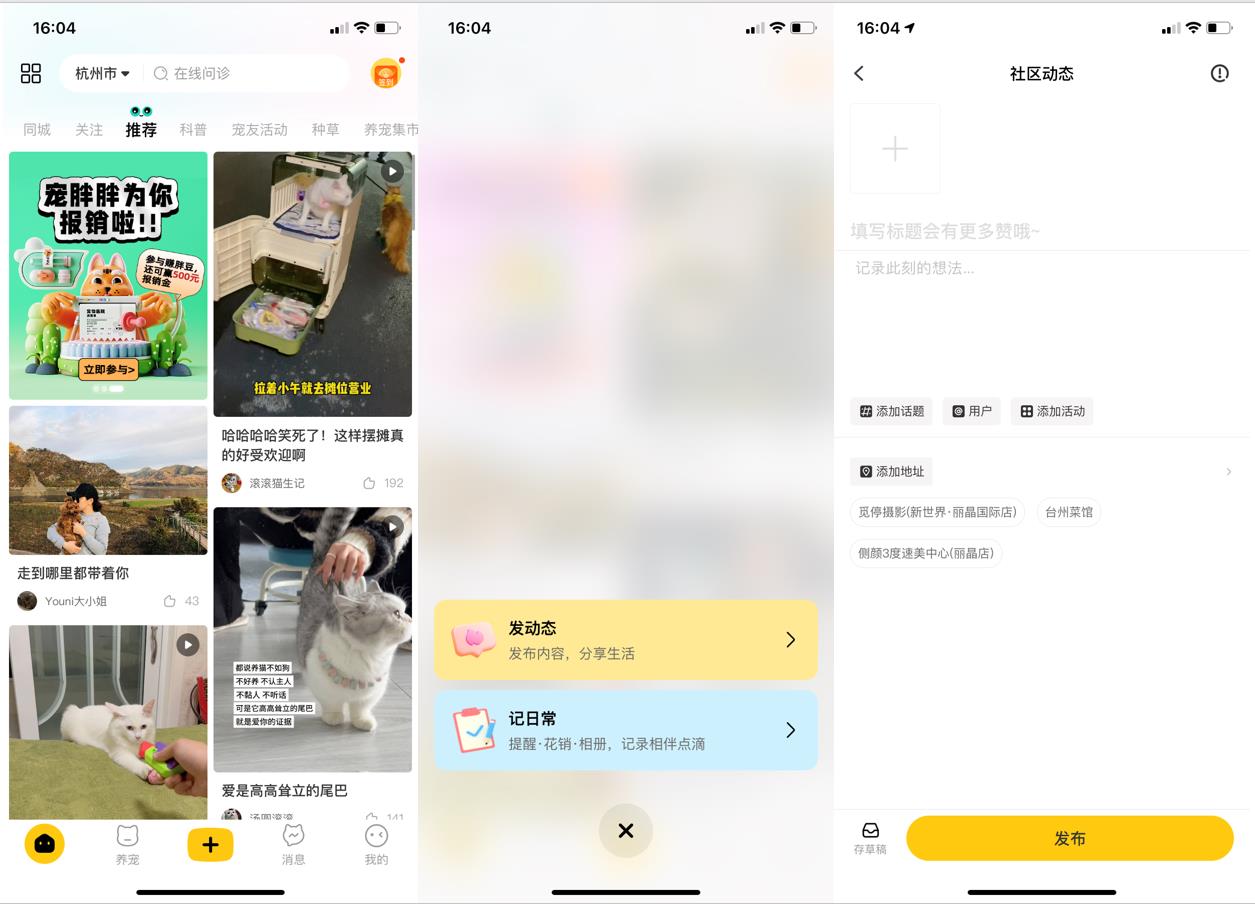

Part of screenshot of Boqi pet publishing dynamic process

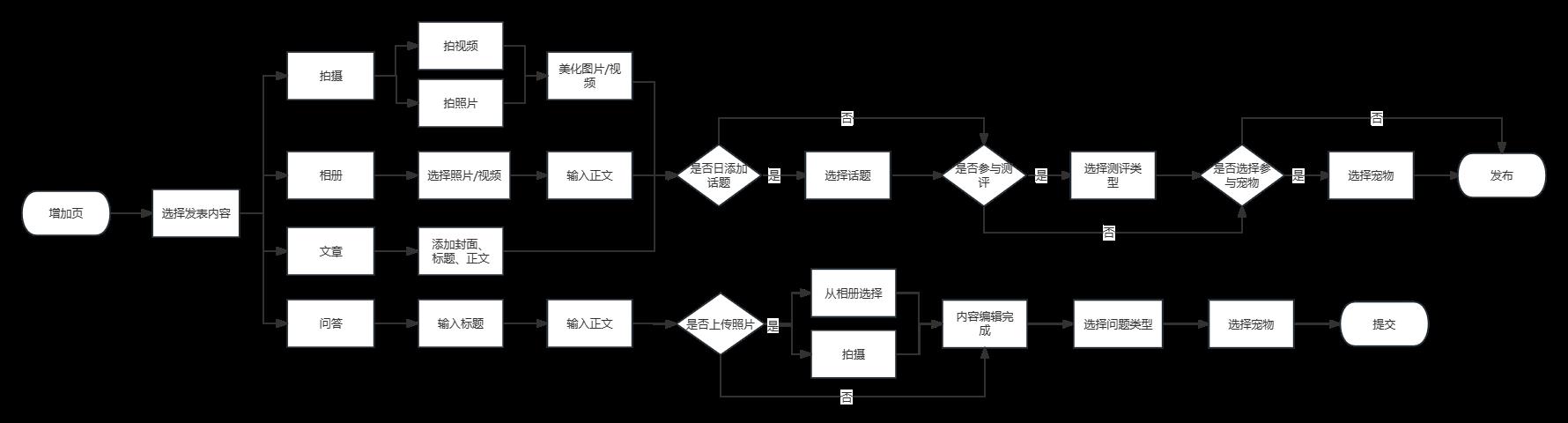

Boqi pet publishes dynamic flow chart.

Experience feelings:

Advantages:

- There are many forms for publishing;

- There is no word limit in editing content, so editing operation is more convenient;

- When uploading photos, you can choose a variety of upload forms, and choosing photos and videos can be simply beautified and edited;

- Pets and related topics can be selected at the bottom of the editing page when publishing trends. On the one hand, it is convenient for users with multiple pets to use, on the other hand, it increases the convenience and versatility of users’ sharing, increases the communication opportunities between users and enhances the product experience.

- The release can participate in the evaluation, which brings convenience for users to plant grass and e-commerce functions.

Insufficient:

- You can’t choose openness in publishing dynamics, but it is open by default, which is not conducive to users who want to keep privacy;

- The published trends need to be viewed from my-personal information, with many levels, and the entrance is hidden, which is not convenient for users to operate;

- In the display of community pages, there are few contents displayed on each page, so it is difficult to identify the contents.

(2) the daily life of the shovel officer

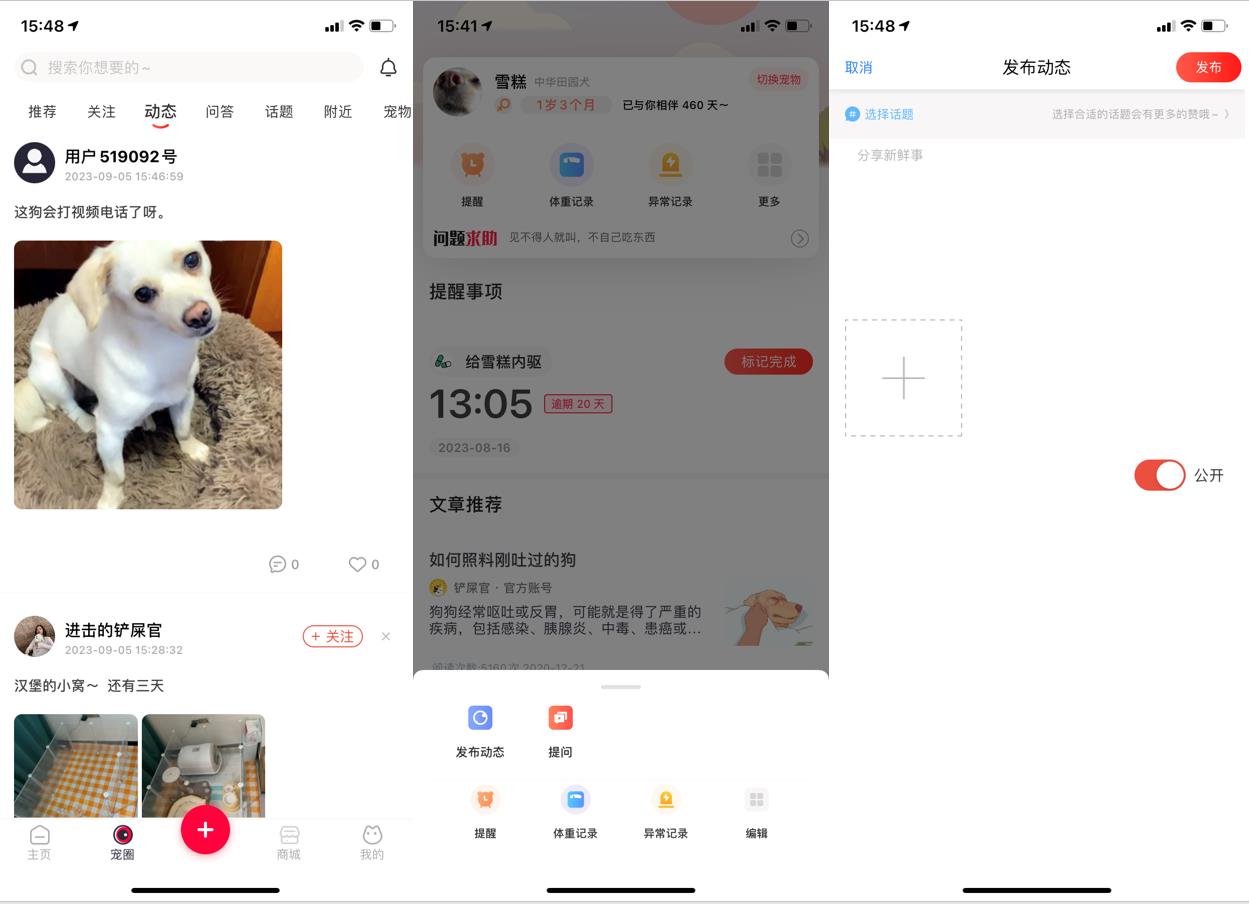

Screenshot of the daily publishing dynamic process of the shovel officer

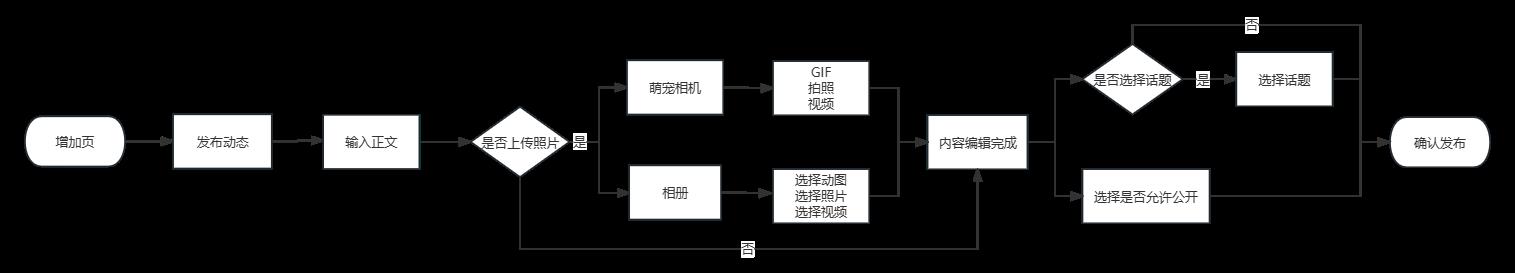

Daily release dynamic flow chart of shovel officer

Experience feelings

Advantages:

- Increase the page entrance obviously, and distinguish it from other buttons by color and button size, which is convenient for users to find;

- The whole process has fewer operation steps, which is simple and convenient for users to operate;

- There is no word limit in editing content, so editing operation is more convenient;

- You can choose whether to make it public or not to protect users’ privacy. In terms of privacy, users can choose whether the content is public or not, which eliminates the concerns caused by privacy issues.

Insufficient:

- When adding a video, you can only select one video at a time. If you want to publish multiple videos, you can only select Add multiple times.

- Not editable when adding photos;

- You can’t save the draft if you exit the editing page and then enter the content that needs to be edited again. If the user accidentally quits the editing page, the edited content will be lost and the user needs to edit it again.

③ Pet chubby.

Screenshot of the dynamic process of pet chubby publishing.

Pang Pang released the dynamic flow chart.

Experience feelings

Advantages:

- When editing content, you can simply edit (crop) the selected photos and simply edit (clip the video length) the selected videos;

- With topics, users, activities, addresses and other related choices;

- In addition to the body content, you can edit the title within 20 words;

- There is a function of saving drafts, and there is a prompt whether to save drafts when quitting halfway.

Insufficient:

- Only one video can be selected when publishing the selected video;

- The selected video cannot be less than 2 seconds.

Through the analysis of the dynamic function process of publishing in three apps, this paper gives some optimization suggestions for the dynamic function of publishing Boqi pet:

- You can add the option whether to disclose it or not, which is convenient for some users.

- When choosing the photo/video format for publication, a title can be added before the text, which is convenient for users to browse different contents. When dynamically displaying to the pet circle, only the title can be displayed, which makes the display page cleaner and easier to browse, and increases the information content of the page.

- After editing the text content, the related options are not limited to pets and topics, and you can add tags, @ Other Users and other options.

- You can improve the personal dynamic portal, raise the level, add personal dynamic functions to the community dynamic homepage, or add recognizable entrance buttons.

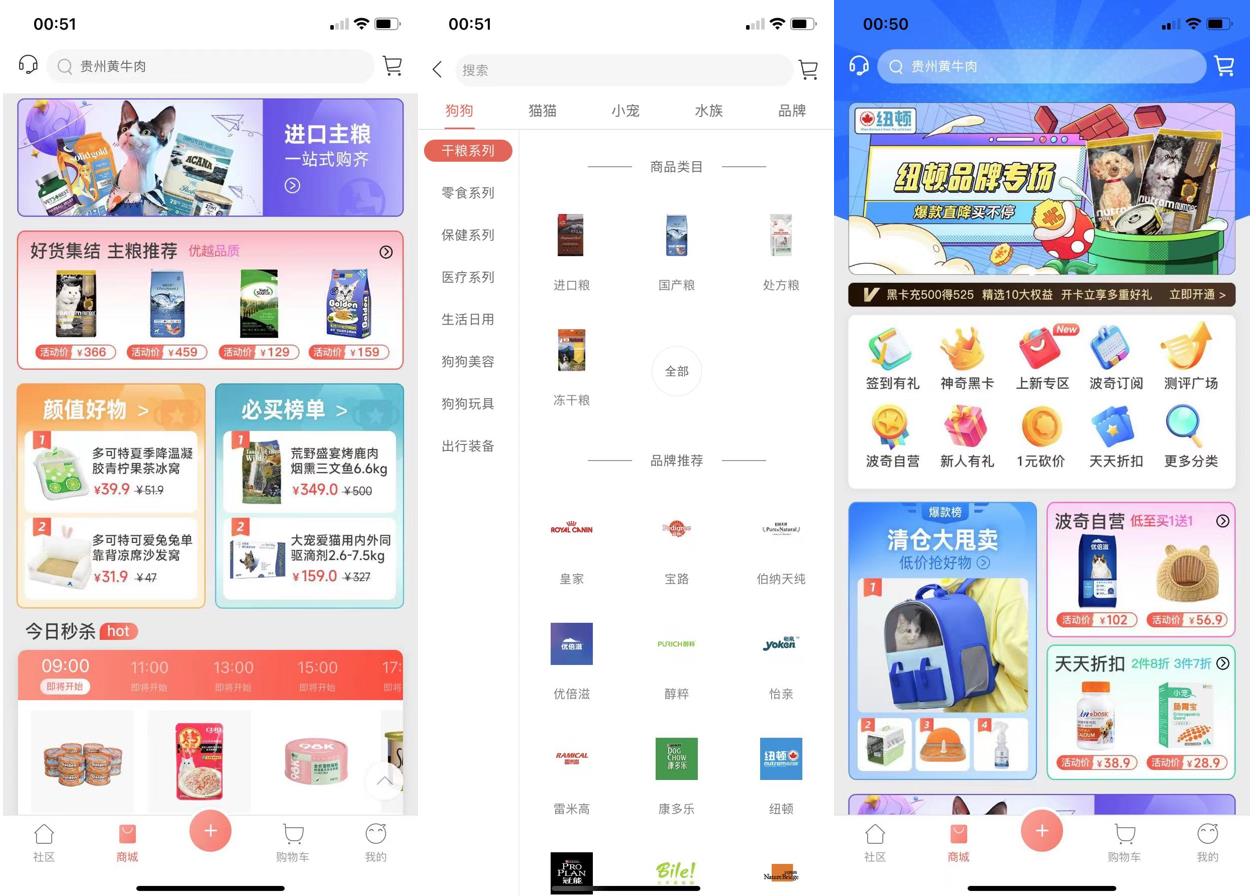

(2) Commodity purchase function

Functional Structure Diagram of Boqi Pet Mall

Functional structure diagram of daily shopping mall of shovel officer

Functional Structure Diagram of Chongpangpang Shopping Mall

The daily life of Boqi pets and shovel officials in the three apps is relatively complete in the e-commerce part. The fat e-commerce part is more inclined to merchants in the same city, and drives the e-commerce part of the whole product in the form of O2O.

Boqi Pet uses the community plate to assist the e-commerce part. For example, the functional plates such as evaluation and talent in the community can help users plant grass, so as to purchase goods and form a cooperation with the e-commerce part. The evaluation square in Boqi pet is a special function, which makes full use of the community function, and a large number of evaluations also make users more efficient when choosing goods.

At the same time, Boqi pets have self-operated goods, and adopting self-operated mode has many advantages. Self-operated goods have more exposure, which not only has higher search weight, but also provides independent entrance for priority recommendation. Self-operated goods have perfect quality assurance and after-sales service; The repurchase rate of self-operated goods is higher, so it is more helpful for the conversion rate and retention rate of users.

Some pages of Boqi Pet Mall are displayed.

The daily life of the shovel officer has an independent shopping mall section, and the search page provides popular search and historical search. Keeping historical search records can make users use this function more conveniently. Among them, the classification of dogs and cats is more comprehensive, but it does not provide the classification of small pets and different pets. Share function is not set on the product details page.

Some pages of the daily shopping mall of the shovel officer are displayed

There is a big difference between the focus of the shopping mall and the other two products. In the shopping mall, the traditional sales of goods are not the main business, but the mode of good goods recommendation is used as the link between online and offline, goods and users. Through the platform, users can browse the general situation of goods, and click on the details of goods to automatically jump to the original product platform for purchase. Chong Pang Pang Mall strives for greater concessions for users, thus improving the retention rate of users.

In the same city merchants section, users can find the services or goods they need faster, and the distance of offline stores can be screened by positioning, which greatly improves the efficiency of users to solve offline needs. At the same time, as an integrated O2O platform, Pangpang can reach cooperation with offline merchants, which is mutually beneficial and win-win. However, due to the particularity of offline transactions, how to ensure the activity of the platform and the retention rate of users is a problem that needs to be considered.

Some pages of Chongpangpang Shopping Mall are displayed.

The market situation of the pet industry is rising steadily, and the pet economy is developing very well. From the analysis of users, the age of consumers is more and more inclined to be younger. With the general increase of consumers’ income, the status of pets in the family is becoming more and more important, and the willingness of pet owners to spend for pets is gradually increasing. The pet industry has a good momentum of "other economy".

(1) Social function

Comparing the products with the dynamic publishing function, the process of Boqi Pet is more comprehensive, and the page hierarchy and interface are relatively simple. When publishing dynamically, you can choose options such as positioning, topic and pet at the same time, which makes the user feel better. Publishing dynamic content can directly participate in commodity evaluation, which also brings convenience for users to plant grass and platform e-commerce to a certain extent, improves users’ activity and stickiness, and has a higher retention rate.

Because the product is a vertical product for pets, the cost of obtaining pet-related content is lower for content viewers, and for content creators, the community operation in the vertical field can get better attention, attract users from both sides through the community, and drain the product at the same time, the community and e-commerce can get very good cooperation, which improves the conversion rate of users and has a positive effect on platform profitability.

(2) mall function

Compared with traditional e-commerce, vertical e-commerce has its own advantages, and vertical e-commerce has more targeted consumer users. The products of interest community can be more convenient from the aspects of customer acquisition mode and user stickiness. Boqi Pet Mall is operated in the mode of B2C+B2B2C, and profits are made by the way of merchants entering+commodity commission+commodity self-management. In view of the daily life of the shovel officer, Boqi Pet has increased the mode of self-operated goods and merchants’ presence. Self-operated goods can face consumers directly, which can obtain higher profits, and at the same time increase consumers’ dependence on the platform. Vertical e-commerce can better understand the characteristics of consumers’ needs, and use the platform to obtain the most direct market information and consumer feedback, so as to optimize products faster and grasp the control rights of users.

From the above analysis, it can be seen that products featuring interest communities can attach importance to the connection between communities and e-commerce, and provide users with interests, popular science, sharing and other services from the community, so as to promote the user activity and user stickiness of the platform by increasing user traffic, and at the same time, use the interaction of users in the community to drain the e-commerce part of the platform.

E-commerce in the vertical field can gain greater trust from consumers, and it is more concentrated in categories. The platform is cooperative with enterprises, and it can also win greater preferential strength for consumers, making users more selective. Therefore, e-commerce in the vertical field should pay more attention to the quality and service of goods and increase the product experience of users. Consumers will be more inclined to choose more professional and trustworthy shopping channels.

关于作者